Tesla shares rose sharply after the world’s largest electric car maker reported a better-than-expected quarterly profit and forecast a “slight increase” in deliveries this year and a significant jump in 2025. The Financial Times reported that recently. In this analytical post, we will reveal the Tesla stock prediction 2025 based on expert opinions and real figures.

Forecast Price & Stock Tesla (TSLA) 2025

Tesla, Inc. (TSLA) was the first of the “Magnificent 7” to report quarterly results. Investors clearly liked the report. Last Thursday, the company’s stock rose 21.9% to $260.48. This day was the best for Tesla shares since May 2013, when the securities for one day added 24% in price, noted CNBC. The closing price was the highest since Sept. 30.

The jump on Thursday offset the losses the stock has suffered since the beginning of 2024: it is now worth 3% more than in January, although it still lags behind the Nasdaq 100 index, which added 22%.

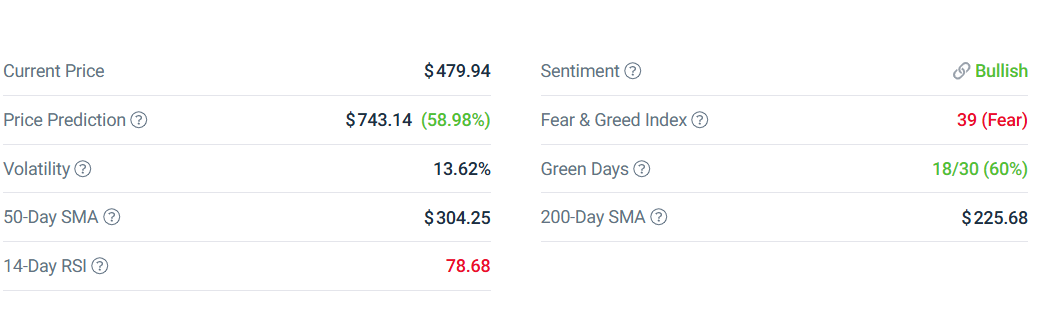

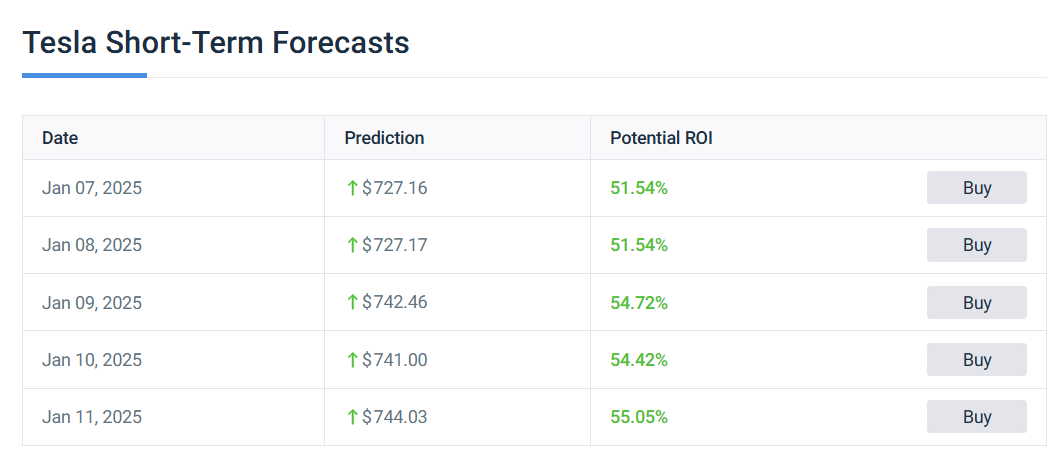

Tesla’s share price appreciation has helped boost the fortune of its CEO, Ilon Musk, by $33.5 billion, Bloomberg reported. Musk ranks first in its ranking of billionaires. The tables below show Tesla stock prediction 2025 and its possible price for the nearest future, along with some other figures.

Forecast Table By Tesla

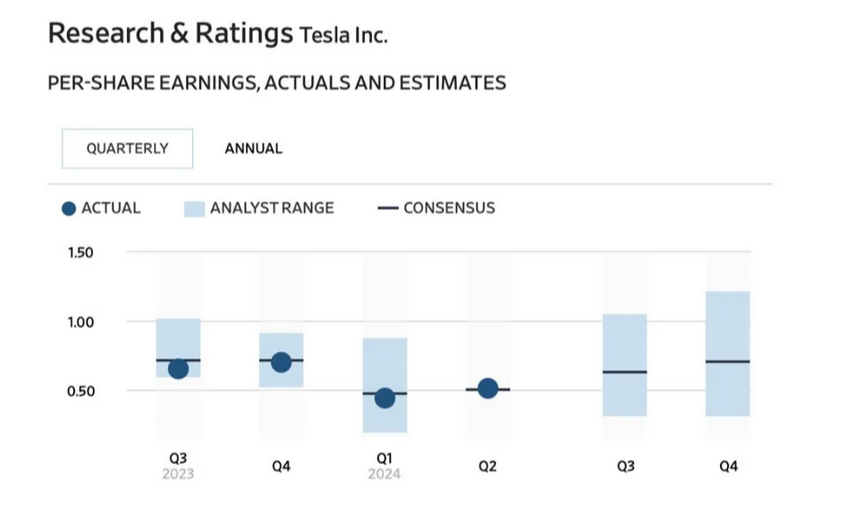

Tesla stock’s net income for the third quarter rose 8% from a year ago to $2.5 billion, beating analysts’ expectations of $2.1 billion. As automotive revenue in general has increased by 2%, this rise fueled the jump in Tesla’s net growth. It is also necessary to keep in mind a 52% rise in energy generation and storage and a 29% boost in revenue from the service division. The last one refers to the multiple charging stations worldwide.

As for the company’s operating expenses, we can notice the drop by 6% to $2.3 billion after cutting 10% of its workforce. In other words, over 14,000 employees were fired in 2024. It had certain negative consequences on the stock price. Below, you can see short-term Tesla stock price prediction 2025.

The official Tesla stock split took place twice, as mentioned above. While a stock split wouldn’t affect the market value of the company, it would cut the share price. More people started to purchase company’s shares.

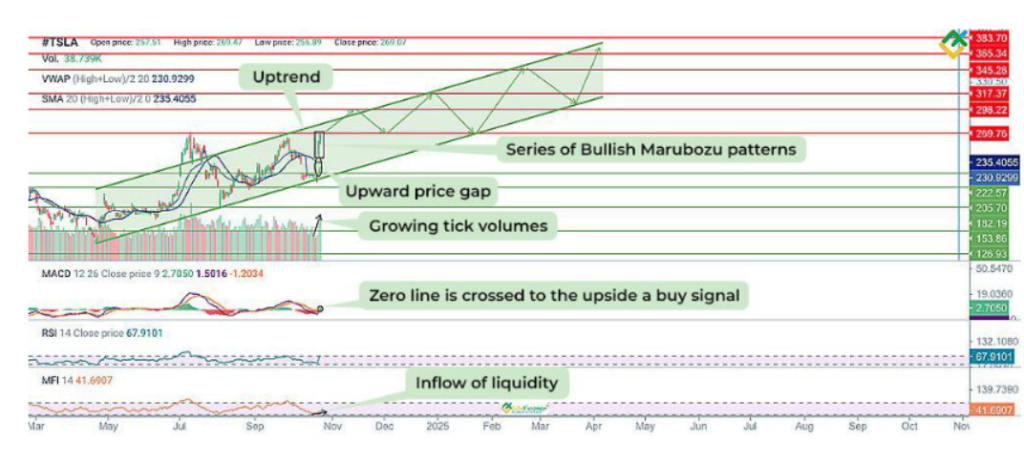

Tesla Stock Price Prediction for 2025 Based on Technical Analysis

Tesla’s stock has been a cornerstone of market innovation. Market trends in the automotive industry caused significant volatility that did not play in favor of Tesla. Besides, global economic conditions and EV technology also negatively impact the Tesla stock’s cost.

Analysts highlight potential support and resistance levels. If everything changes for the better, the price per Tesla’s share may achieve up to $300-$450 in 2025. It depends on how effectively the company will implement its growth strategies.

To come up with a more-or-less accurate Tesla stock price prediction 2025 and exclude too high risks, investors should monitor Tesla’s production targets, expansion plans, and key market indicators closely. It is useful to keep an eye in real-time.

Factors Affecting TSLA Stock Price

Many investors wonder, “What happens if I buy Tesla stock today?” It’s necessary to understand which factors impact the formation of price per stock.

The stock market operates on the principle of supply and demand. It means that the more potential buyers, the more expensive the asset is. The purchase price reflects the market value, but as the asset changes hands, the cost fluctuates.

Nominal and market value

The nominal (or book) value is set during the initial public offering (IPO). This indicator is defined as the share of the firm’s total capital equal to one stock.

The nominal price is indicated on the share itself or becomes known from the company’s public reports. The current market value can be found on stock exchanges and in various online sources. With accurate figures at your disposal, it is quite easy to calculate the difference between the real and nominal value: just subtract the smaller value from the larger one.

The difference often also depends on the type of share in question: ordinary vs. preferred.

Value creation

Price fluctuations reflect investors’ perceptions of a company’s role in the stock market. Their judgment is certainly influenced by current profitability: in other words, how much profit the company is making.

However, investors often go beyond numbers. Therefore, investors’ investments often show not only the current value of the company, but also the growth prospects expected from the firm in the future.

There are special quantitative methods used to estimate such prospects called “dividend discount models” (DDM). “Discounting” in this context means a certain rate – that is, the amount of money that an investor must pay right now for the right to receive future profits.

Factors to Keep in Mind When Analyzing Tesla Stock Price

Gordon’s growth model treats value as an infinite value that grows due to a constant inflow of money over an infinite period of time. But in real life, companies don’t grow equally fast from year to year, meaning that revenue cannot increase at the same rate.

Therefore, it is worth considering other factors that also affect the company’s capitalization. They can be divided into fundamental and technical factors.

In an ideal stock market, prices would be determined mostly by fundamental factors. The most important of them are:

- Yield (e.g., profit or dividends from each purchased asset)

- Expected growth in yield

- Discount rate

- Risks of the investment

All of them are interrelated. For example, the expected increase in profitability directly depends on the riskiness of the investment:

The most important technical factors include:

- Inflation

- State of the macroeconomy

- Investor demographics

- Market trends

- Liquidity of assets, etc.

Different investors take different indicators into account when closing deals in the stock market.

What is Social Media Saying About TSLA (Tesla) Market Sentiment?

In late 2024, Musk predicted that car sales could increase 20-30% next year thanks to cost cuts that will lower prices on existing models, which in turn will drive demand.

He also cited improvements in autonomous driving technology and new products, including the unmanned “Cybercab” unveiled earlier this month. Musk noted that lower interest rates reduce monthly loan payments, which has a positive impact on demand.

Additionally, Elon Musk announced on the X social network that he had initiated an important change in the design of the front of the Robotaxi and that it would take time to demonstrate “a few other things.”

However, the questions like, “Why is Tesla stock down” are still relevant. All of a sudden, Tesla shares dropped by 8.5% to $241 on July 11. Musk and other authorities explain that the reason is the new corporation’s project. Right, new projects do not always mean higher revenues from the very beginning. They still can fail. The innovation is the self-driving taxi, which was postponed from August 8 to October 10, 2024. That caused that drop.

Investing in TSLA: Pros and Cons

Over the past month, shares of Tesla Inc. (NASDAQ:TSLA) have surged more than 40% in a blink of an eye. At the same time, the overall profitability of the famous company goes down. Why? The demand for electric cars dropped a lot. The last time Tesla’s income changed with the speed of light was June 2023. Still, can we claim that Tesla stock forecast 2025 is 100% positive? Are there any potential risks?

From June 28 to July 10, 2024, the electric car manufacturer’s shares soared 33% to $263.26. Sp, why is Tesla stock down?

This happened amid two major news stories:

- Elon Musk presented Tesla’s self-driving taxi technology

- Investors bet on the company’s new developments in artificial intelligence

According to analysts’ forecasts, earnings per share in the third and fourth quarters may increase to the same period of the previous year. Financial performance is weaker than expected. The odious figure of Elon Musk also adds uncertainty to the company’s future

The company’s current share price is more based on growth expectations and investor confidence in the tech giant’s future, especially with regard to developments in artificial intelligence, than on its actual financial performance.

How long the issuer will be able to keep the faith in a possible breakthrough with artificial intelligence is a big question. The influence of the previous restructuring of the electric vehicle manufacturer is obviously strong. Thus, the corporation has to get rid of this impact to maintain investor interest in Tesla’s assets. Another chance to catch up with the leaders again is to diversify its business. The ideas include energy solutions, software and services, etc.

Wall Street Believes in Tesla’s Stocks

Is Tesla a good stock to buy according to experts from Wall Street? Wall Street analysts show growing confidence in Tesla’s stocks, citing strong innovation, expanding market presence, and promising growth in EV demand. Tesla remains a key player with significant long-term potential in the automotive and energy sectors.

How We Do Forecasts

Will Tesla stock go up? We cannot tell you for sure but we can give you a hint on how to make predictions.

Here are a few key things to consider about the companies behind the stocks being analyzed, as well as the market conditions in which they may be most attractive.

- Management. Who is steering the ship and what is their track record in the industry? Do they have the trust of shareholders?

- Financial status. Understand the state of the company’s balance sheet. What are its assets, liabilities, and cash flows? Research revenue for recent periods.

- Innovation. How does the company innovate to stay ahead of and respond to competitors? How have customers and shareholders received new products and services?

- Dividends. Does the company pay dividends? Will they go up? How often do they pay out? All these questions matter.

- Volatility. How volatile has the price movement of this stock been and what are the reasons for the extreme fluctuations? With volatility naturally comes risk, but also potential opportunity.

Finally, think about liquidity. This indicates how easy it is for traders to enter and leave the market.

Price History TSLA

Is Tesla Stock a buy? Remember that cheap does not necessarily mean good. It does not necessarily mean profitable, either. Cheapness can mean that investors lack confidence in the growth prospects. Calculate the price-to-earnings ratio (P/E) by dividing the company’s stock price by its earnings per share. Investors should track the price change in real-time to have an overall idea of how Tesla behaves in the stock market.

More About Tesla

Let’s recall the Tesla stock split history. Tesla, Inc. (TSLA) has completed two TSLA stock splits since its initial public offering (IPO):

- August 31, 2020: a 5-for-1 stock split, where each existing share was divided into five.

- August 25, 2022: 3-for-1 stock split, with each share further subdivided into three.

Were these decisions beneficial? At least, they aimed to multiply the total number of shares. For investors, it was a good sign as the price per share became more affordable. These actions still maintained the overall market capitalization.

Tesla’s decision to split its shares into two was mainly driven by a desire to make its shares more accessible to retail investors and increase liquidity. High share prices can serve as a barrier for individual investors, and a stock split is an effective way to mitigate this problem.

Conclusion: To Buy or Not to Buy?

So, you may ask, “Should I buy Tesla stock today?” Despite Tesla’s unexpectedly strong quarterly earnings report, there are doubts that the company will remain in the “Magnificent Seven,” a list of the most successful big techs in the U.S., Yahoo Finance writes.

Freedom Capital Markets chief global strategist Jay Woods compared Tesla to Bitcoin, suggesting that the stock is trading based more on “hopes and dreams” than on fundamentals.

According to MarketWatch, a total of 58 analysts are tracking Tesla stock. Of those, 24 of them recommend buying the stock (Buy and Overweight ratings), 21 recommend holding (Hold), and 13 advise selling (Underweight and Sell). Anyway, it’s up to you to decide whether to invest in this company or not, but, thanks to the Tesla stock split, its shares are affordable now.

FAQ

Where will Tesla stock be in 5 years?

Tesla’s stock is expected to grow as the EV market expands, though predictions vary widely.

What will Tesla be worth in 2030?

Estimates suggest significant growth by 2030, but exact valuations depend on market trends and competition.

What is the stock prediction for Tesla in 2025?

Analysts forecast significant growth, with varying price targets depending on market conditions and Tesla’s performance.

Is Tesla a good stock to buy?

Tesla is considered a strong long-term investment due to its innovation and leadership in the EV market.

Is Tesla stock expected to rise?

Many experts predict Tesla’s stock will rise, driven by EV adoption and global expansion.

What should you do with Tesla stock: buy, sell, or hold?

The decision depends on your financial goals; consult an advisor for personalized advice.